- Where We Do Business

- When do you need a will?

- SFA At a Glance

- The Nautilus Group®

- Newsletters

- Eagle Strategies, LLC

- Individual Planning

- Events on Wall Street

- Our Involvement

- Resources for Professional Advisors

- SFA Blog

- Our Location

- Planning Process

- Will you pay the AMT?

- Should you tap retirement savings to fund college?

- Risk Management Planning

- Retiring the 4% Rule

- Where is the market headed?

- What Smart Investors Know

- The Richest Man in Babylon

- Safeguard Your Digital Estate

- A Bucket Plan To Go With Your Bucket List

- The Rule of 72

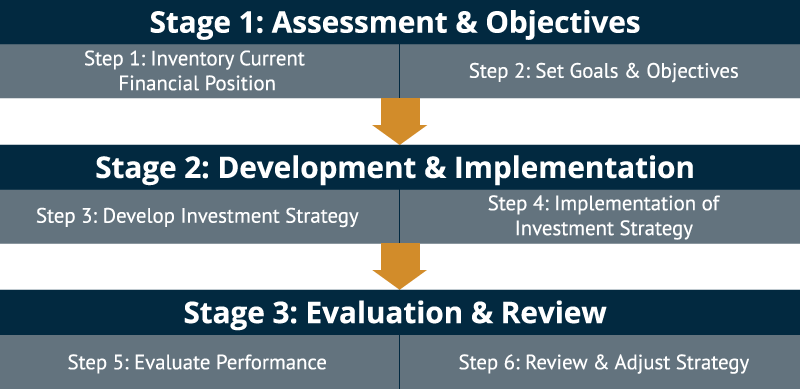

- The Investment Process

- Our Strategic Partnerships

- Executive Planning & Benefits

- Estate Management 101

- Video Learning Library

- Estate & Legacy Planning

- Group Benefits

- Concept Pieces on Planning Strategies

- Life Plan for your Business

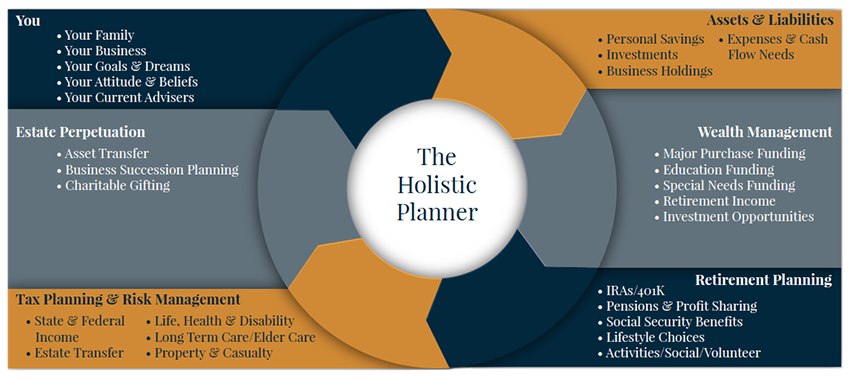

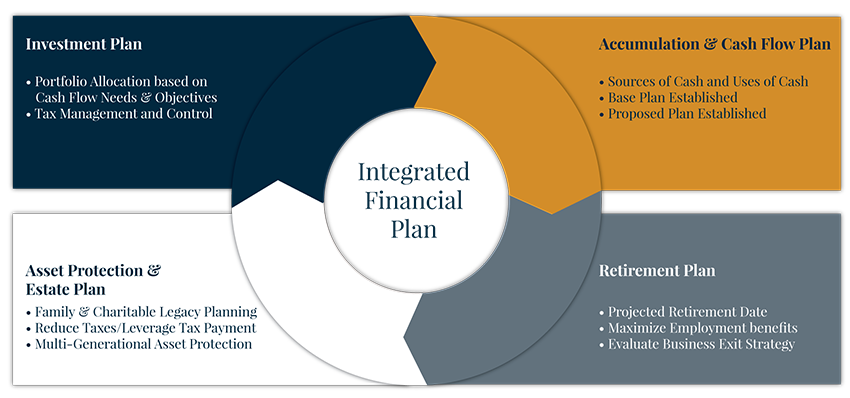

Individual PlanningFinancial PlanningThe Holistic Planning Process is a comprehensive financial planning process designed to coordinate the many aspects of your financial life into a cohesive whole. The objective is to give you a better sense of where you are, where you wish to go and how best to get there. SFA customizes a solution in consideration of personal goals and objectives, cash flow needs, risk tolerance, tax realities and time horizons. By coordinating all aspects of your financial life, we take the burden off of you to manage multiple resources or advisors. As essential as it is to construct a proper strategic plan, it may be even more important to continually revisit the various components of the plan and implement strategic or tactical changes in light of dynamic circumstances. SFA places a great level of importance on continual dialogue and periodic review meetings with you. Our best relationships are with clients who appreciate both our advice and our hands-on service approach. Who is paying taxes? Wealth Management SolutionsEffective investment planning does not occur by accident, but rather requires thoughtful and rigorous analysis as well as adherence to proven portfolio strategies. The most successful plans are continually monitored to ensure they remain relevant to your situation, given prevailing economic and market conditions. Clients benefit from our access to a wide variety of research capabilities and customized portfolio solutions, tailored specifically to your goals, objectives and tolerance for risk. Our approach is anything but cookie-cutter, but rather customized to meet your unique financial and lifestyle needs. Our access to some of the best advisor solutions available today provides our clients the opportunity to benefit from customized portfolio construction and professional management.

Investments/Balanced PortfolioDiversified PortfoliosInvestments and EmotionsRetirement PlanningRetirement goals differ from client to client, but the basic premise remains the same. Whether you plan on travelling, spending more time with family, pursuing a new hobby or even working part time, you do not want to outlive your financial resources. Developing a realistic plan that addresses funding sources, growth projections and eventual distribution will raise awareness of what you need to save in order to comfortably enjoy your later years. Integral to developing a prudent retirement plan is a discussion of the tax implications you may face when the time comes to withdraw funds from your various savings vehicles. We work with you to minimize your tax burden as you build your wealth and transition through retirement. Granted, taxes are a reality for all of us, though you may benefit from our expertise in crafting coordinated tax, estate and gifting strategies aimed at minimizing your tax bills and those of your heirs.

Retirement ConcernRetirement Money - What to take first? |

Contact Info

6901 Rockledge Drive, Suite 700

Bethesda, MD 20817

Map and Directions

Phone: (301) 214-6700

Fax: (301) 214-6653

Quick Links

Quick Links

6901 Rockledge Drive, Suite 800

Bethesda, MD 20817

Phone: (301) 214-6700

Fax: (301) 214-6653